Picture this: It’s 1672, and England’s King Charles II, ever the life of the party, realizes the royal coffers are emptier than a Puritan’s dance card. To keep the good times rolling without the pesky burden of debt repayment, he decides to simply stop paying his bills—a move charmingly dubbed the “Stop of the Exchequer.”

This masterstroke led to immediate financial chaos. The goldsmith bankers, predecessors to our modern banks, found themselves as solvent as a leaky ship. Prominent financiers like Edward Backwell and Robert Vyner went belly up, dragging countless investors and businesses down with them. The economy took a nosedive, and England’s credit reputation was left in tatters. But hey, at least the king didn’t have to pawn the crown jewels—yet.

Fast forward a few centuries to Argentina in the late 1990s—a country that danced the tango with economic disaster. The government, in its infinite wisdom, pegged the Argentine peso to the U.S. dollar, aiming for stability but achieving the economic equivalent of tying one’s shoelaces together.

As external shocks hit and recession loomed, the government’s response was a masterclass in indecision. Austerity measures were introduced, then relaxed, then reintroduced—much like a cat unsure of whether it wants to be inside or outside. This fiscal hokey-pokey eroded public confidence, leading to massive capital flight, skyrocketing unemployment, and a default on $132 billion of public debt. The lesson? When your economic strategy resembles a soap opera plot, expect drama.

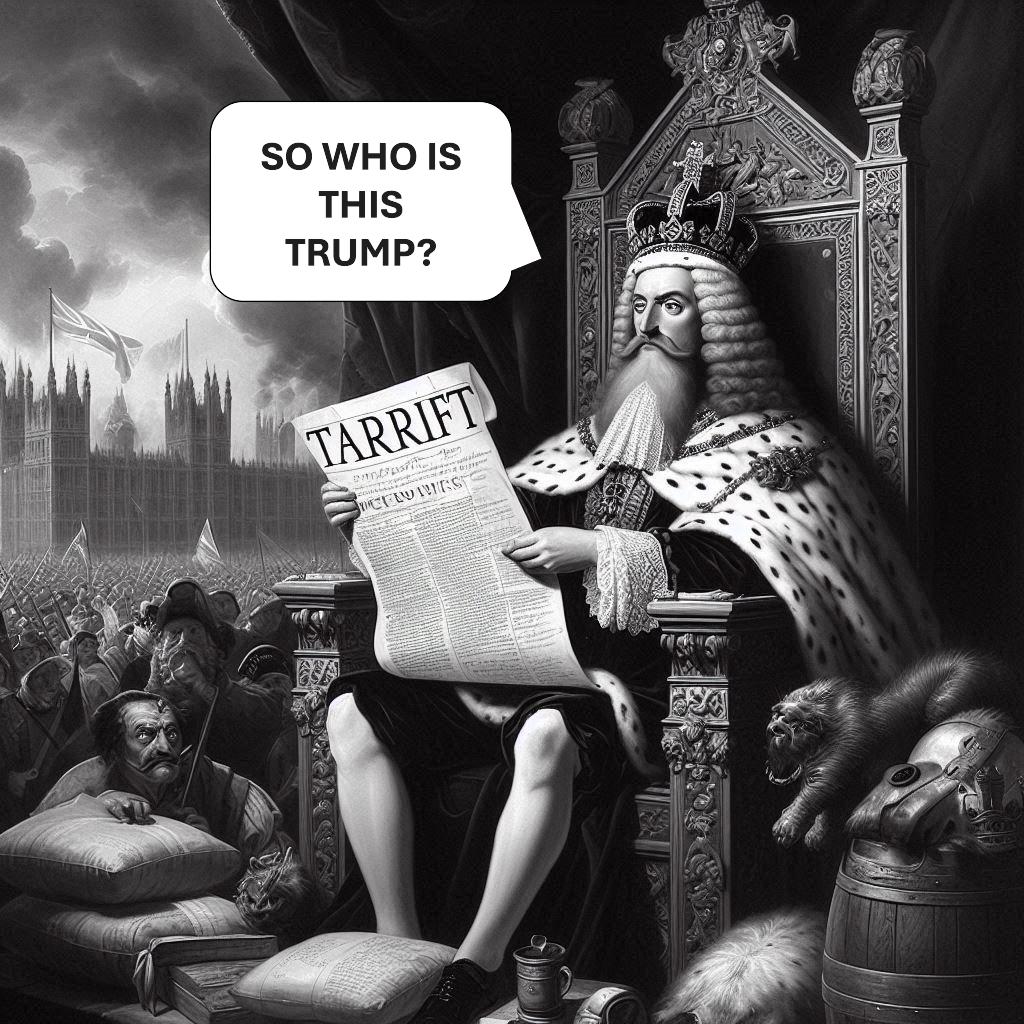

Now, let’s swivel our skeptical eye to the present, where history doesn’t just rhyme—it plagiarizes. President Donald Trump, in a display of policy acrobatics that would make a gymnast dizzy, has once again flip-flopped on tariffs. Just days ago, he imposed a 25% tariff on imports from Canada and Mexico, only to reverse the decision faster than you can say “NAFTA.”

Now, let’s swivel our skeptical eye to the present, where history doesn’t just rhyme—it plagiarizes. President Donald Trump, in a display of policy acrobatics that would make a gymnast dizzy, has once again flip-flopped on tariffs. Just days ago, he imposed a 25% tariff on imports from Canada and Mexico, only to reverse the decision faster than you can say “NAFTA.”

Businesses and investors are left clutching their balance sheets, bewildered by the administration’s erratic trade policies. One day it’s tariffs on steel and aluminum; the next, it’s a sudden exemption. It’s as if the White House trade policy is being decided by a Magic 8-Ball stuck on “Ask again later.” This unpredictability has led to market volatility, with the S&P 500 taking a nearly 2% tumble—a financial rollercoaster ride no one queued up for.

What’s the common thread weaving through these tales of woe? A government’s inability to maintain a steady course, leading to economic upheaval and public disillusionment. Whether it’s a 17th-century monarch dodging debts, a South American nation waltzing into default, or a contemporary leader treating trade policy like a game of hopscotch, the result is the same: instability, uncertainty, and a populace left holding the bag.

So, as we rinse and repeat through the annals of tariffs and history, remember this: The more things change, the more our leaders find creative ways to trip over the same old mistakes. Until next time, keep your skeptical glasses polished and your sense of humor intact.